Choose the Perfect Plan for Your Career Growth

Programs crafted to help you excel—whether you're beginning your journey or advancing your skills,

Campus Credentials has the right fit for you!

Begin your placement journey with complete aptitude prep!

- Access to foundational study materials

- Practice tests for aptitude topics

- Webinars on career guidance

- Basic resume templates and tools

- Email support for query resolution

- Regular course updates with quizzes

Begin your journey with the Complete Placement Masterclass!

- Complete access to all aptitude materials

- Choose between Java and Python courses

- SQL and logic-building exercises and lectures

- Regular quizzes and lecture updates

- Comprehensive career development resources

- 24/7 query resolution support

Begin your placement journey with complete technical preparation!

- Access to technical lectures and materials

- Choose between Python or Java courses

- Includes SQL as part of the curriculum

- Focus on logic-building exercises

- Course updates with quizzes and lectures

- Support through email and chat

Sections

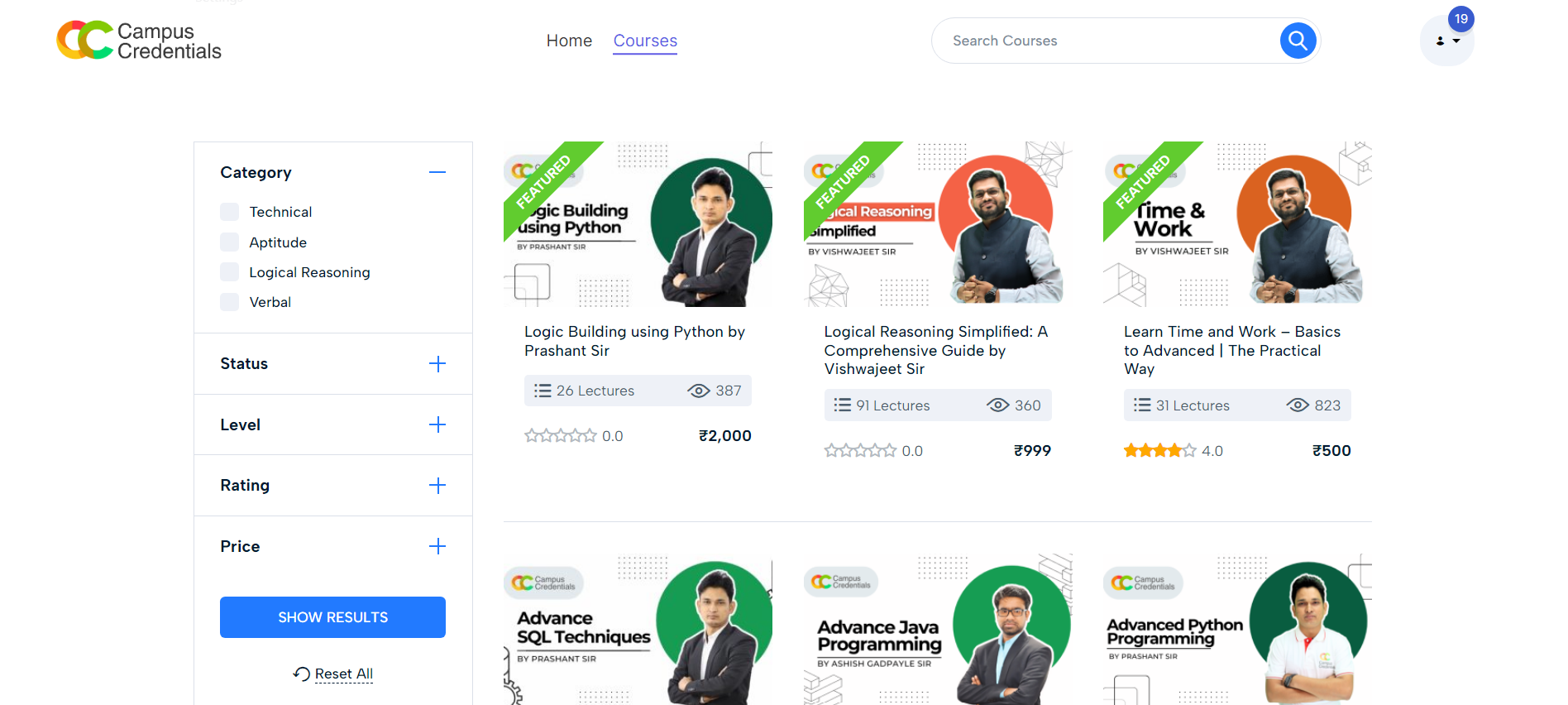

Courses

Logical Reasoning Simplified: A Comprehensive Guide by Vishwajeet Sir

A Comprehensive Guide by Vishwajeet Sir is an extensive online course meticulously designed to help individuals master the art of logical reasoning. This course covers a wide array of logical reasoning topics, including puzzles, sequences, analogies, and critical reasoning. Ideal for those preparing for competitive exams, enhancing professional skills, or simply looking to improve their logical thinking abilities, this course offers practical insights and advanced strategies to tackle various logical reasoning challenges.

Advanced Python Programming by Prashant Jha Sir

This course focuses on building Advanced python programming reasoning skills, a vital asset for programmers, understanding syntax and problem solvers alike. Understanding how to break down complex tasks into manageable steps and develop efficient algorithms is essential in various fields such as software development, data analysis, and automation. Whether you’re a beginner or looking to strengthen your logical thinking, this course will guide you through the foundational concepts and practical applications.

Advance Java Programming By Ashish Gadpayle Sir

the Advance Java Programming course by Ashish Gadpayle Sir is a comprehensive course designed to establish a strong foundation in Java programming. It covers fundamental concepts such as syntax, data types, and control structures, while also delving into core object-oriented programming principles like classes, inheritance, and polymorphism. The course introduces commonly used Java libraries, exception handling techniques, and basic data structures such as arrays and lists. Additionally, it addresses file handling and provides an overview of multithreading for concurrent programming. Emphasizing practical exercises alongside theoretical knowledge, the course equips students with the skills necessary to effectively utilize Java in real-world software development scenarios.

Get Certified with Campus Credentials

Core Python Certification

Gain fundamental and advanced Python skills with certification.

- Live and Recorded Sessions

- Industry Projects

- Hands-on Learning

Mastering Python Through Project-Based Learning

Master Python by building real-world projects.

- Live and Recorded Sessions

- Hands-on Projects

- Industry-Oriented Curriculum

Java Mastery Certification: From Fundamentals to Advanced Concepts

Become proficient in Java with a structured certification program.

- Live and Recorded Sessions

- Comprehensive Java Training

- Industry Projects

Mastering Java Through Project-Based Learning

Learn Java by working on real-world projects.

- Live and Recorded Sessions

- Hands-on Learning

- Industry Relevant Projects

Mastering SQL: From Fundamentals to Advanced with Projects

Master SQL with hands-on projects and real-world applications.

- Live and Recorded Sessions

- Practical Database Training

- Advanced SQL Techniques

Mastering C Programming: From Fundamentals to Core Concepts

Learn C programming from scratch to advanced applications.

- Live and Recorded Sessions

- Comprehensive Curriculum

- Hands-on Projects

Mastering C++: Comprehensive Certification for Modern Programming

Learn modern C++ programming techniques and best practices.

- Live and Recorded Sessions

- Project-Based Learning

- Industry-Oriented Curriculum

Enhance Your Learning Experience

Access our Resource Portal for a wealth of free resources and books. Elevate your skills by enrolling in expertly crafted courses through our LMS Portal to boost your career prospects.

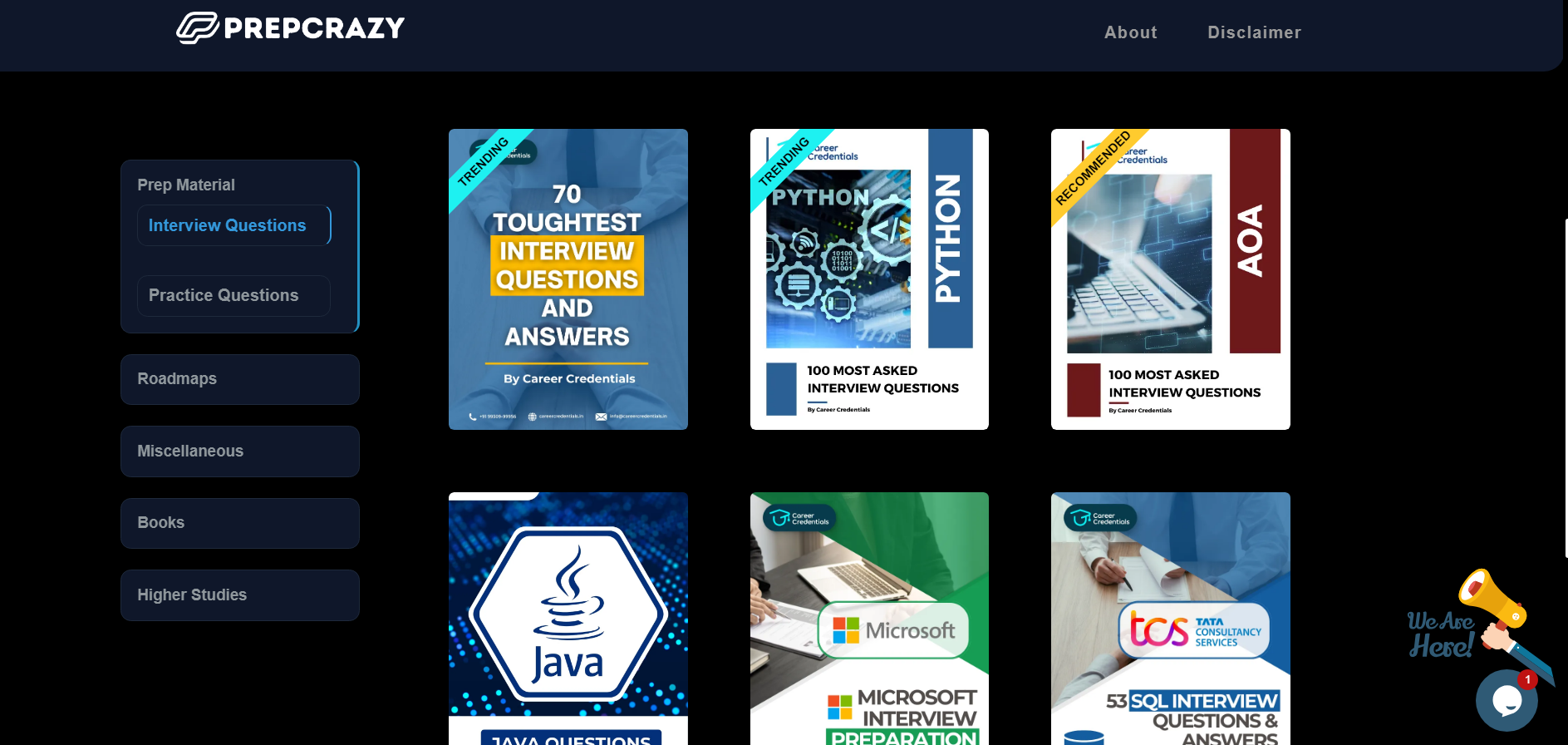

Free Online Books and Resources

- Access 150+ books covering technology, aptitude, and career development

- Download resources for free to support your learning journey

- Explore materials on coding, problem-solving, and technical skills

- Stay ahead with aptitude guides for competitive exams and interviews

- Kickstart your career with comprehensive, downloadable study content

Learning Management System by Campus Credentials

- Engage with trainers directly through interactive Q&A discussions

- Track your learning progress with real-time updates and reports

- Earn certifications to boost your resume and career prospects

- Access courses anytime, anywhere with a user-friendly mobile platform

- Join live webinars and recorded sessions for flexible learning

Everything you need to know

Here are the most questions people always ask about.

.svg?updatedAt=1731239516352)